The residential real estate market is no stranger to floor plans — they’re often part of the home selling process, typically included in the marketing of a listing. However, in recent months, floor plans have significantly increased in importance to the sale, moving from a nice-to-have to a must-have for realtors.

Why have floor plans shifted to a necessity, and how do they benefit real estate professionals beyond marketing? TWO WORDS: Desktop Appraisals.

What’s Changed with Appraisals

During the pandemic, the Federal Housing Finance Agency allowed appraisers to complete home appraisals remotely, primarily as an effect of lockdowns, social distancing, and a lack of appraisers in the market. This temporary measure was made permanent for single family homes as of March 19, 2022, with Fannie Mae and Freddie Mac accepting desktop appraisals.

Because appraisers no longer need to perform a physical inspection of qualifying residential properties, floor plans that show gross living area and other standards are part of the new requirement.

Benefits of a Floor Plan

Today’s hot market combined with a lack of appraisers means the traditional appraisal process can take up to 20 days or more to get an appraisal back. This two to three week time frame opens up both sides to potential issues:

- For the seller – Lost opportunity if the buyer doesn’t move forward based on the appraisal

- For the buyer – Lost opportunities to bid on other homes if the appraisal comes back too low

- For both the seller and buyer – Personal setbacks such as inability to prepare for closing, selling current home, or packing

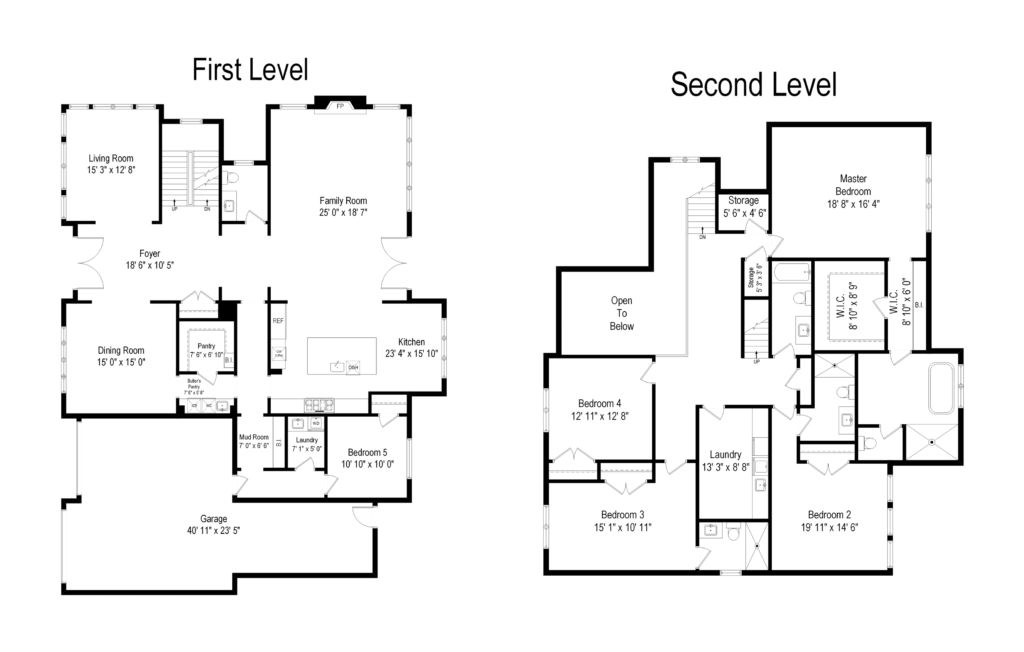

Floor plans have always been a useful marketing asset. They help buyers visualize their movement through a house before visiting it, and also help the new owners determine the size and placement of furniture in each room. So it’s no surprise that more than two-thirds of online home shoppers found floor plans to be “very useful,” according to the National Association of Realtors 2021 Home Buyers and Sellers Generational Trends Report.

The news from Fannie and Freddie, however, makes them even more beneficial because it ensures quicker closings narrowing the time frame to a few days, positively impacting all parties involved.

When agents already have a floor plan, the remote appraisal and mortgage approval process can start as soon as the seller accepts an offer – saving valuable time. And for brokerages that have a mortgage arm or preferred mortgage company, the quick close is doubly attractive.

Make Floor Plans Part of Your Marketing Process

Whether you hire an individual or a company that offers floor plans in conjunction with other services such as photography (like VHT Studios), getting a floor plan created ahead of time makes the selling and closing process easier.

Keep in mind that for remote appraisals, Fannie and Freddie have specific floor plan requirements, including certain standards and it must be created by a disinterested third party (not by the seller, buyer, or agents). Be sure your floor plans are created by a well-established provider who understands the law, rights, IP, licensing, etc. It’s the best way to limit your exposure and liability for licensing and copyright infringement.

The evolution of the lending process to include desktop appraisals only drives home the growing importance of floor plans – they are both a marketing tool and a sale closer.

Sianei Parker

April 22, 2022Thank you for sharing I will order floor plans for all my future listings.

josh Dotoli

September 26, 2022Hello, this is a very informative blog for floor plans. thank U soo much for this information